Bend, Oregon, is a city in the county seat of Deschutes County, Oregon. In Bend, closing costs typically range from 2-5% of the purchase price. It means that on a $200,000 home, you can expect to pay between $4,000 and $10,000 in closing costs.

Knowing the closing cost upfront can help you budget for your new home and avoid unexpected expenses. So when you’re house hunting in Bend, be sure to ask about closing costs so you can be prepared!

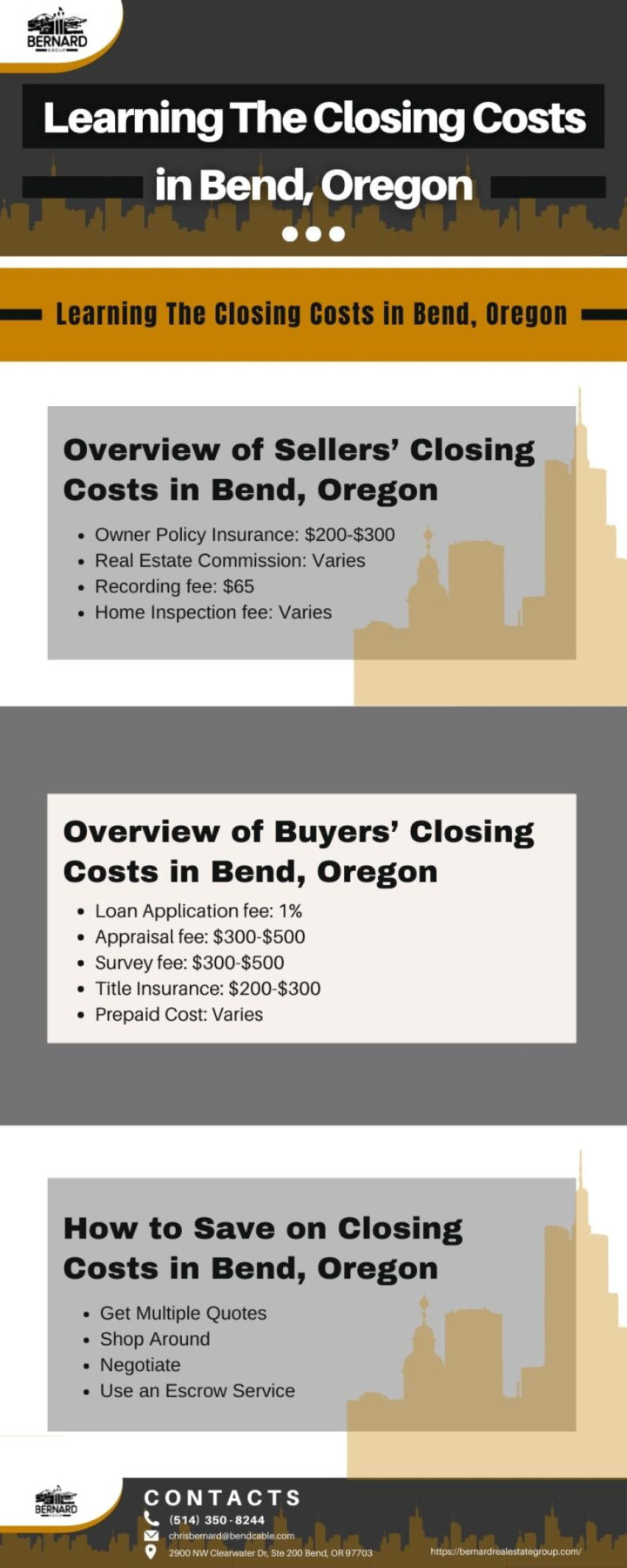

Overview of Sellers' Closing Cost in Bend, Oregon.

When selling a home in Bend, Oregon, sellers can expect to pay several closing costs. These include the real estate commission, loan origination fees, and title insurance.

Sellers should be aware of these costs so they can budget accordingly. In addition, sellers should also factor in the cost of any repairs or upgrades that need to be made before listing the home.

By being prepared for these costs, sellers can help ensure a smooth and successful sale to avoid unnecessary burdens when putting up their homes on the market.

Some of the closing costs sellers are required to pay are explained below.

Owner Policy Insurance: $200-$300

Owner Policy Insurance is an essential type of insurance policy that protects the buyer against Liens, defects on the property, and the seller against liability, theft damages, or other disasters.

It is imperative in Bend, Oregon, where the risk of wildfires is high. Owner’s insurance gives you peace of mind and protects your investment.

Real Estate Commission: Varies

Real Estate Commission is a fee charged by real estate agents for their service. In Bend, Oregon, Real estate commissions are negotiable, so it’s essential to shop around and compare fees before selecting an agent.

Bend’s average real estate commission is 5%, but some agents may charge 7% or more.

Recording fee: $65

The seller pays the recording fee at the time of closing, which is used to cover the costs of recording the deed with the local government.

In Bend, Oregon, the recording fee is currently $65. This fee is paid to the Deschutes County Recorder’s Office and is used to cover the costs of processing, storing, and maintaining vital records.

Home Inspection Fee: Varies

Home inspection fees vary based on the size of the home, but they typically range from $200 to $500. The seller usually pays the fee at closing in Bend, Oregon.

Home inspections are an essential part of the home-buying process, as they can identify potential problems that may not be apparent during a casual walk-through.

Overview of Buyers' Closing Costs in Bend, Oregon.

You can typically expect to pay between 2 and 5% of the home’s purchase price in closing costs as a buyer. This means that on a $300,000 home, you would be looking at $6,000 to $15,000 in closing costs. These costs can include the loan origination fee, appraisals, inspections, and title insurance.

While this may seem like a lot of money, it’s important to remember that these costs are usually due at closing and paid directly to the various service providers involved. In other words, they’re not an out-of-pocket expense for you as the buyer.

Additionally, many lenders will allow you to roll your closing costs into your loan, so you don’t have to pay them upfront.

If you’re still worried about how you’ll cover your closing costs, talk to your lender or real estate agent. They may be able to point you in the right direction, whether it’s through closing cost assistance programs or other financial resources.

Closing costs are just one part of the home-buying process. By being prepared and knowing what to expect, you can help ensure a smooth and successful transaction.

There are likely variations in buyers’ closing costs in Bend, which can be due to various reasons such as neighborhood, size of the property, kind of property, mortgage rules, government policies, and lots more.

Some closing costs buyers should expect to include:

Loan Application Fee: 1%

Loan Application fee is also known as the mortgage origination fee. It costs about 1% of the mortgage amount.

Appraisal Fee: $300-$500

An appraisal fee is usually paid to an appraiser to determine the value or worth of the house. Depending on the kind of property, size of the property, and the location. The appraisal fee costs around $300 to $500.

Survey Fee: $300-$500

A surveyor will be hired to measure the property’s boundary, location, and legal description. It costs between $300 to $500.

Title Insurance: $200-$300

Title insurance is a type of insurance that protects the buyer of property against title defects. Lenders typically require it as part of the closing costs on a home purchase. In Bend, Oregon, title insurance is available through the Title Company of Central Oregon.

The company offers two types of title insurance: owner’s title insurance and lender’s title insurance. The owner’s title insurance protects the buyer from unknown title defects.

In contrast, the lender’s title insurance protects the lender from title defects that could result in a collateral loss on loan.

Title insurance is an integral part of the home-buying process, and it’s essential to understand your options before you purchase a policy.

It costs around $200 to $300 to get title insurance in Bend, Oregon.

Prepaid Cost: Varies

Prepaid costs are those expenses that the buyer will need to pay at closing to get the property ready for move-in. This can include Bend city impact fees, HOA dues, and Oregon documentary stamps.

While prepaid costs vary from property to property, they can add several thousand dollars. Therefore, buyers need to be aware of these costs and factor them into their budget when considering a purchase.

With some planning and foresight, prepaid costs can be easily managed and should not deter anyone from homeownership.

How to Save on Closing Costs in Bend, Oregon

When it comes to saving on closing costs, Bend, Oregon, is a great place. There are several ways to save on closing costs in Bend, and many of them are relatively easy to do. Here are some tips on how to save on closing costs in Bend:

Get multiple quotes:

The more quotes you get for closing costs, the better. Getting multiple quotes from different lenders will help you get the best deal possible.

Shop around:

Not all lenders are created equal. Some will charge higher fees than others. Shopping around and comparing offers from different lenders is a great way to save on closing costs.

Negotiate:

Don’t be afraid to negotiate with your lender. Closing costs can often be negotiable, so it’s always worth asking for a lower rate or fee.

Use an escrow service:

If you’re working with a real estate agent, they may be able to recommend an escrow service that can help you save on closing costs. Escrow services typically charge lower fees than traditional lenders, so this is worth considering.

Final Thoughts

Whether you’re a buyer or seller, it is essential to be conversant with the best information on closing costs in Bend, Oregon. You’re sure to get the latest update by going through this article.

For further questions on closing costs in Bend, Oregon, reach out to me. I’ll be glad to help.